EMPLOYMENT SERVICES

Supply of Qualified Personnel in All Branches of Blue / White Collar

- Hector can meet your personnel demands in the required areas promptly and accurately thanks to its large data bank and expert staff,

- We conduct preliminary interviews on behalf of your company in accordance with the criteria you have determined,

- If you wish, we organize vocational training,

- Hector saves up time by working as your company’s HR unit.

INCENTIVES

Supply of Qualified Personnel in All Branches of Blue / White Collar

- With employment incentives, employers who employ previously unemployed personnel that meet certain conditions are provided with premium, tax or wage support for varying periods and amounts.

- While some of these incentives are financed by the Turkish Employment Agency, the operator of the transaction is the Social Security Institution.

- The incentives financed by the Unemployment Insurance Fund with the aim of protecting and increasing employment are summarized in the table below.

Name of Incentive | Legal Basis |

Employment Incentive for Women, Young People and Those With Vocational Qualification Certificate | Provisional Article 10 of Law No. 4447 |

Additional Employment Incentive | Provisional Article 19 of Law No. 4447 |

Financing Facility Support for Additional Employment | Provisional Article 31 of Law No. 4447 |

Incentive for Employment of Unemployment Allowance Recipients | Fifth paragraph of Article 50 of Law No. 4447 |

Minimum Wage Support | Provisional Article 88 of Law No. 5510 |

1.İlave İstihdam Teşviki

- Additional Employment Incentive

It is implemented within the scope of temporary articles 19 and 21 of Law No. 4447.

- Conditions sought for the insured:

– Not having insurance under 5510/4-a,b,c for more than 10 days in the three months prior to the month they were hired,

– Being unemployed registered with İŞKUR,

– Employment by private sector employers between 1/1/2018 and 31/12/2022,

required.

- Conditions sought in terms of workplace:

– Belonging to a private sector employer,

– Employment of the insured in addition to the average in the monthly premium and service documents or concise premium service declarations reported from the workplace for the calendar year preceding the employment date,

– Submitting the monthly premium and service documents to SSI within the legal period,

– Payment of accrued insurance premiums within the legal period,

– No overdue insurance premiums, unemployment insurance premiums, administrative fines and related delay penalties and late payment debts,

– There is no indication that it did not report the people it employs as insured or that it did not actually employ the insured people.

- Support amount

The amount of support will be calculated differently according to the sector in which the workplace operates.

- All premiums to be paid by each additional insured for the amount of earnings subject to premium up to 17,256 TL, provided that it does not exceed the amount to be found by multiplying the daily gross minimum wage for the relevant period by the number of premium payment days of the insured in workplaces operating in the manufacturing or information sector (2,426,63 TL to 6.471 TL) will be covered.

- All premiums (2,426,63) to be calculated over the lower limit of earnings subject to premium for each insured person to be employed in workplaces operating in other sectors will be covered.

Support Period

Provided that the month of 2022/December is not exceeded, the support period is 12 months for each insured employed between 1/1/2018 and 31/12/2022. However, if the employed insured person is older than 18 years old, male younger than 25 years old, a woman older than 18 years old or a disabled person registered with the Institution, the support will be applied for 18 months.

Additional Rules

The President is authorized to determine the workplaces that will benefit from the support in the IT sector.

Workplaces included in the scope of Law No. 5510 between 1/1/2018 and 31/12/2022 and businesses that did not employ insured persons in the year in which the average number of insured persons was calculated, although they were registered before; After the date of 1/1/2018, the insured for the first time benefit from this support for 12 or 18 months starting from the third month following the month of notification.

Other insurance premium incentives, support and discounts cannot be benefited from for the same insured in the month in which this incentive is used.

- Encouragement of Women, Young People and Those with Vocational Qualification Certificate

The social security premium employer’s shares up to the upper limit of earnings subject to premium of private sector employers employing unemployed persons until 31.12.2022 are covered from the Unemployment Insurance Fund.

Terms of use

– The person has been unemployed for the last 6 months

– Employment of the person in addition to the average number of insured employees for the last 6 months before the date of employment

– Being a private sector employer

Benefit period

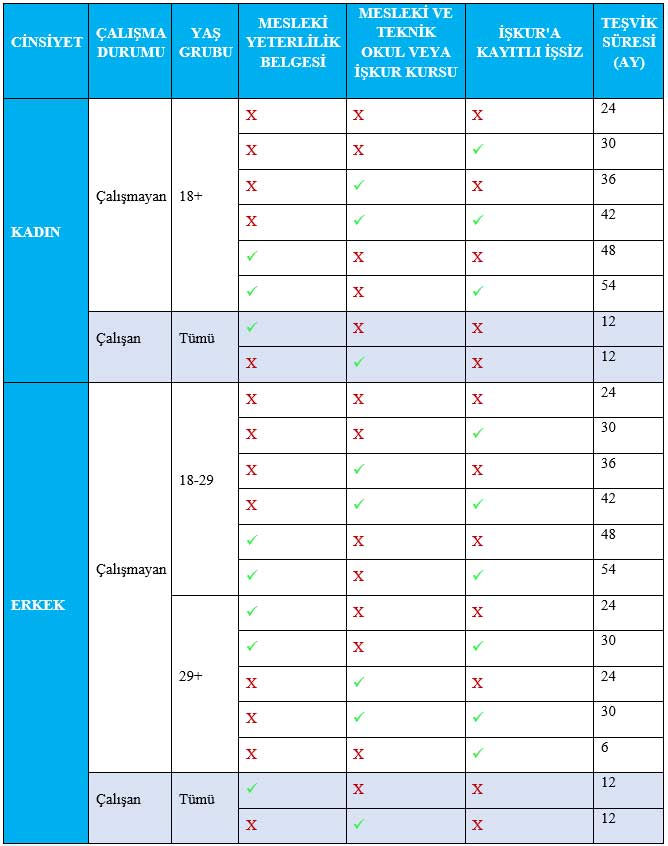

– 24 to 54 months for employers employing women aged 18 and over,

– 12 to 54 months for employers employing men aged 18-29,

– 6 to 30 months for employers employing men aged 29 and over,

– While working; 12 months for employers who obtain vocational competence certificate after 01.03.2011, complete vocational and technical education, or employ those who have completed labor force training courses,

period of support is provided. In order to encourage being registered with İŞKUR, a provision has been made to add 6 months to the support period if the person is registered with İŞKUR.

The monthly premium and service certificate must be submitted to SSI within the legal period and the premiums must be paid within the legal period by the employers.

Tablo 1. 6111 Sayılı Kanuna Göre Sigorta Prim Teşvikinden Yararlanma Süreleri

Incentive for Unemployment Allowance Recipients

For those who receive unemployment benefits; In the last six months before the date of employment, in addition to the average number of insured persons declared in the premium and service documents, the whole of the unemployment benefit (2,167,79 TL), excluding 1% of the social security premium calculated over the minimum wage, is covered by the Insurance Fund.

The period of support provided to the employer is deducted from the individual’s total entitlement period initially determined for unemployment benefits.

The monthly premium and service certificate must be submitted to SSI within the legal period and the premiums must be paid within the legal period.

If the employee starts to work again in the workplace where he left the job, these incentive provisions cannot be benefited.

Disabled Employment Incentive

For each disabled person employed by private sector employers, the entire minimum wage level of social security premium employer shares (1,326.56 TL) is covered by the Ministry of Treasury and Finance.

Minimum Wage Support

For the July to December/period of 2022, the amount to be found by multiplying the total number of premium payment days for the insured persons notified from the workplaces meeting the conditions specified in the Temporary Article 88 of the Law No. 5510 and 3.33 Turkish Liras, is deducted from the insurance premiums that these employers will pay to the Institution. The amount is covered from the Unemployment Insurance Fund.

Requirements for Employers:

-Being a private sector workplace employer,

-Being a public workplace employer other than the public administrations specified in the table (I) attached to the Law No. 5018.

Conditions Required for the Insured:

-Being one of the insured persons to whom the provisions of long-term insurance branches are applied within the scope of subparagraph (a) of the first paragraph of Article 4 of the Law No. 5510.